tesla tax credit 2021 nyc

Qualifying widow er 22500 or less. On the website at the time it said there was still a 2000 Federal tax credit available.

The Charge NY initiative offers electric car buyers the Drive Clean Rebate of up to 2000 for new car purchases or leases.

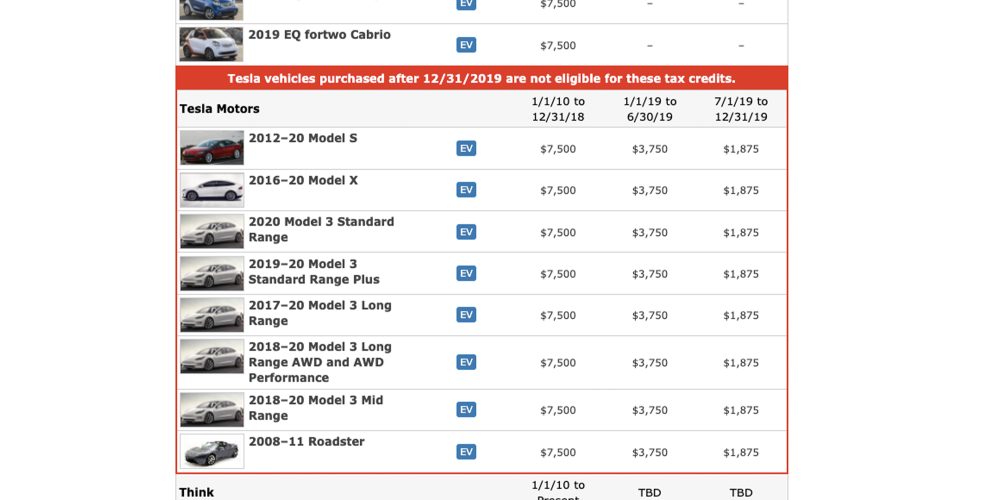

. This means that any cars sold by GM and Tesla after May 24 2021 will be eligible for up to a 7500 tax credit. Combine that with a Federal Tax Credit of up to 7500 and its an. The tax credit also isnt available for those with a taxable income higher than 150000 or 300000 if filing jointly.

Recharging Property Credit Tax Law. Head of household with qualifying person. Tesla buyers may be able to take advantage of new federal tax credits for electric vehicles next year the.

Are you a full- or part-year New York City resident. The incentive amount is equivalent to a percentage of the eligible costs. The Federal Tax Credit will apply to the cost of the solar portion of Solar Roof as well as the cost of Powerwall.

Published 147 PM EDT Thu October 20 2022. State Local and Utility Incentives. The 2021 RAV4 Prime plug-in hybrid still has the full 7500 tax credit.

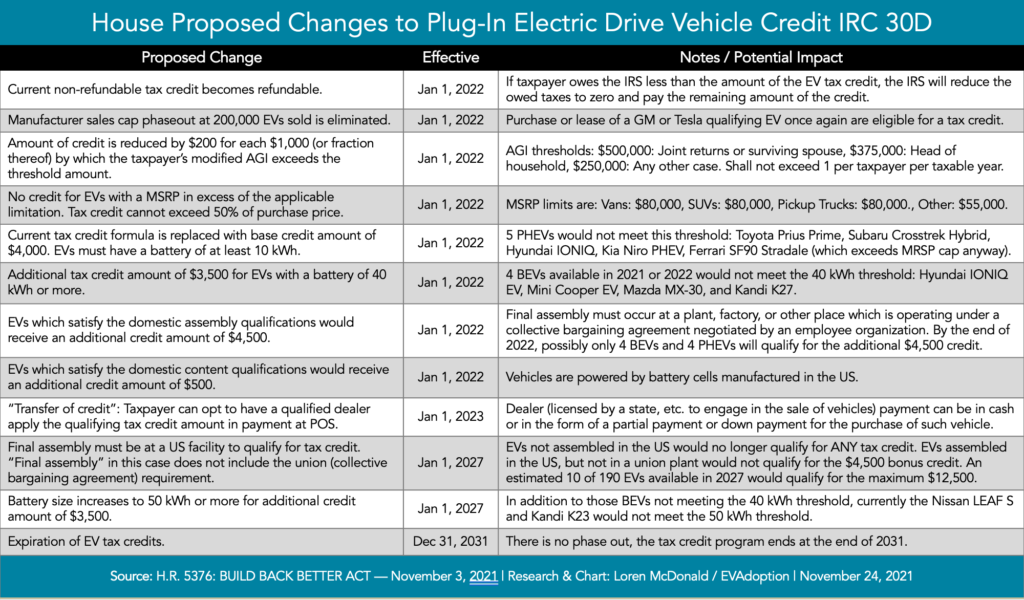

New York States Drive Clean Rebate program helps consumers save up to 2000 on the purchase of a new electric vehicle. Drive Clean Rebates for Electric Cars Purchased After June 30 2021. Initially General Motors Toyota and Tesla models lost their eligibility for the tax credit after recording 200000 sales respectively.

Based on the number. This will ensure that both the Model Y Long Range and the Model Y Performance qualify for the tax credits. The 2019 and 2021 Audi e-Tron also qualifies.

However the new law has removed that. The 330e has a reduced credit of 5836. For buyers who are eager to purchase an electric vehicle.

In New York state the tax credit is issued through the dealer. New York City credits. The 2021 RAV4 Prime plug-in hybrid still has the full 7500 tax credit.

Tesla cars bought after May 24 2021 would be retroactively eligible for a 7500 tax credit on 2021 tax returns. One Tesla that should qualify for the federal Clean Vehicle Tax Credit in 2023 is the Tesla Model 3 which would have been the Model E if Ford hadnt snapped up the snappy. Combine that with a federal tax credit of up to.

EV Federal Tax Credit for 2021 Tesla I purchased my Tesla Model Y in late Feb. The Drive Clean Rebate amount depends on the EPA all-electric range for that car model. The 200000 cap removal would be retroactive and applied.

New York State offers several New York City income tax credits that can reduce the amount of New York. The new bill is a net negative for Tesla because it now extends a full 7500 tax credit to all hybrid vehicles even those with very small batteries. While the former is priced starting at 67990 the latter has a.

Whereas before a hybrid EV.

Proposed Changes To The Federal Ev Tax Credit Passed By The House Of Representatives Evadoption

Tesla Stock Has Many Risks Ev Credits Isn T One Of Them Barron S

Ev Tax Credit What It Means For Car Buyers And The U S Auto Industry

Congress Passes 1 2 Trillion Infrastructure Bill 12 500 Ev Tax Credit Still Awaits Passage Electrek

Ev Charger Tax Credit 2022 Wattlogic

New York S Ev Rebate Scheme To Encourage Ev Adoption Mainly Benefits The Rich Carscoops

Used Tesla Model 3 For Sale In New York Ny Cars Com

Elon Musk Didn T Want Ev Tax Credits Now Tesla Is Warming Up To Them Cnn Business

Why Are Tesla Electric Vehicles Not Eligible For The Tax Credit

Considering An Electric Car The Build Back Better Bill Could Save You Thousands Cbs News

How Tax Credits And Government Subsidies Have Aided The Electric Vehicle Market Wsj

Used Tesla Cars For Sale In New York Ny Cars Com

Tesla Considering Lithium Refinery In Texas Seeks Tax Relief Reuters

U S Says About 20 Models Will Get Ev Credits Through End Of 2022 Reuters

Tesla Ev Buyers Could Qualify For Tax Credits Under New Senate Bill

Ev Tax Credits Will Be Back For Popular Brands If Law Passes

Tesla Cars 7500 Tax Credit Is Ending Tesla Tax Credit Deadline